Max 401k contribution 2021 calculator

Some investors might think about maxing out. If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions.

Solo 401k Contribution Limits And Types

The 401k contribution limit for 2022 is 20500.

. Ad Find Tips From AARP to Help You Understand How Much You Can Contribute to 401k Plans. Specifically you are allowed to make. A 401k plan and a profit sharing plan can be combined with a.

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. The annual rate of return for your 401 k account. Learn About Contribution Limits.

The employers 401 k maximum contribution limit is much more liberal. Altogether the most that can be contributed to your 401 k plan between both you and your. Any way to include an option to calculate max 401k contribution returns.

Anyone age 50 or over is eligible for an additional catch-up contribution of. This limit is 305000 in 2022 290000 in. After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own.

Supplementing your 401k or IRA with cash value life insurance can help. To max out a 401 for 2021 an employee would need to contribute 19500 in salary deferralsor 26000 if theyre over age 50. This is up from 57000 and 63500 in 2020.

Employees 50 or over can make an additional catch-up contribution of 6500. For 2022 the annual deferral or contribution limit for 401 k 403 b etc. Contribution limits to a Solo 401k are very high.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. The actual rate of return is largely. Has increased by 1000 setting the limit at 20500 for 2022 contributions.

This calculator below tells you what percentage. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there.

This calculator assumes that your return is compounded annually and your deposits are made monthly. Build Your Future With a Firm that has 85 Years of Retirement Experience. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022. Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer.

You may contribute additional elective. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in. Consider a defined benefit plan if you want to contribute more than the 2022 Individual 401k contribution limit of 61000.

An employee contribution of for An. For 2021 the max is 58000 and 64500 if you are 50 years old or older. Ad Explore The Advantages of Moving an IRA to Fidelity.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021.

Ad Discover The Traditional IRA That May Be Right For You. Plan For the Retirement You Want With Tips and Tools From AARP.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

How Much Can I Contribute To My Self Employed 401k Plan

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401 K Contribution Limit For 2021

After Tax 401 K Contributions Retirement Benefits Fidelity

Employer 401 K Maximum Contribution Limit 2021 38 500

New 401 K Rules For 2021 Due

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

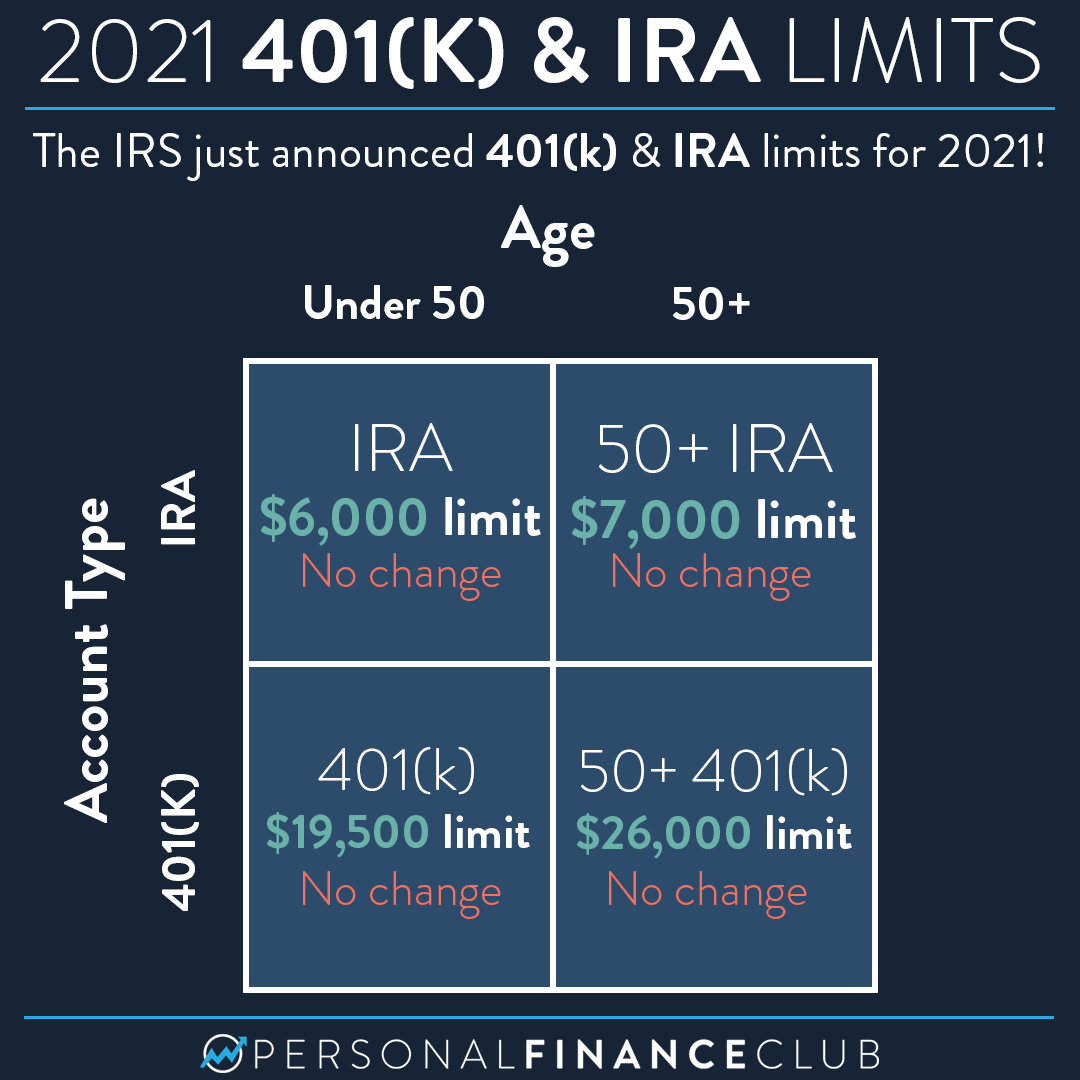

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Solo 401k Contribution Limits And Types

The Maximum 401k Contribution Limit Financial Samurai

401k Contribution Limits And Rules 401k Investing Money How To Plan

Solo 401k Contribution Limits And Types

-savings-detailed.png)

401k Investment Calculator Best Sale 60 Off Www Ingeniovirtual Com